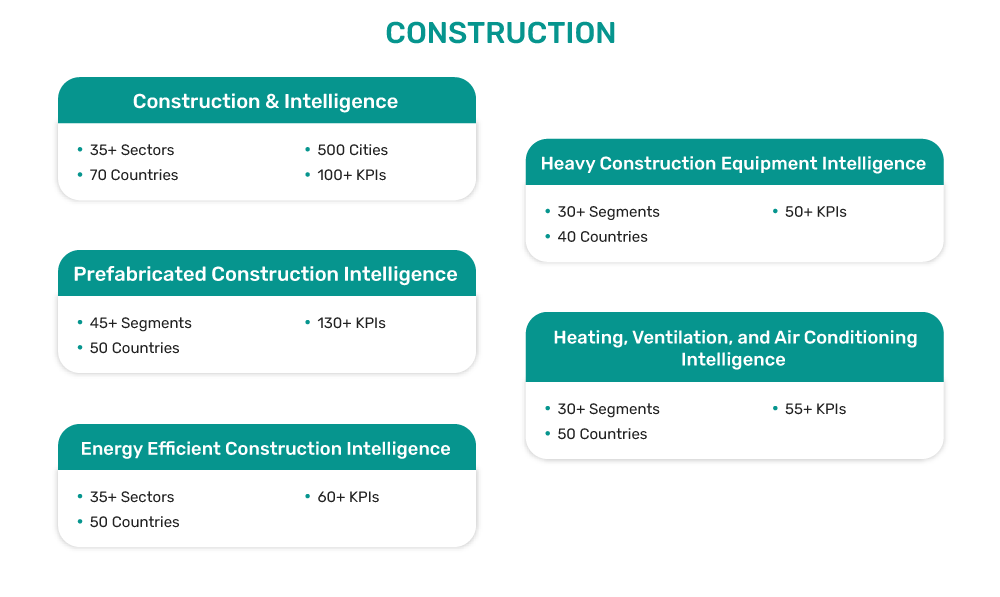

ConsTrack360's offers extensive data, insights and opinion on changing dynamics across a range of markets within building and infrastructure construction, green building, and prefabricated technology. We combine best practices, emerging business models, consumer insights, and market innovation to help our clients identify unique opportunities.

Build winning business strategies by accurately valuing market opportunities and assessing risks, creating strategy decks for board meetings, conducting channel and competitor analyses, track emerging trends and technologies, and keeping an eye on market innovation.

Experience the power of 360° intelligence, combining best practices, emerging business models, disruptive technology, and market innovation to identify unique opportunities.

Find out more

ConsTrack360 combines industry dynamics, impact of disruptive technologies, and market innovations to offer the most comprehensive intelligence.

Leveraging a global network of analysts, we create business intelligence offerings focused on delivering accurate data and actionable insights.

ConsTrack360’s proprietary analytics platform tracks thousands of data sources to provide quantified actionable intelligence.

Track development across value chain in over 70 key economies, delivering comparable datasets for better investment and strategic decision making.

Inflation, recessionary fears, and labor woes have continued to dampen the growth of the global construction market. The surge in construction material prices has resulted in project delays and spending decline from private players, including tech firms that have suspended construction activities of their hyper scale data center projects, manufacturing, and industrial facilities around the world.

The surge in construction costs has also meant higher housing prices, thereby affecting global housing sales. The Federal Reserve, along with other central banks globally, is projected to announce further rate hikes in H1 2023. As a result, ConsTrack360 expects a further decline in housing sales, thereby affecting the growth of the residential construction market. However, government measures and spending on infrastructure projects will assist the construction sector growth over the next three to four years.

Spending on infrastructure projects is expected to further increase in India in 2023. From transportation to utility and building various tourism destinations, spending on infrastructure projects has been consistently increased by the Narendra Modi-led national government. This trend is projected to further continue in India from the short to medium-term perspective.

Road, railways, and urban infrastructure projects are projected to remain a priority under the annual budget, which is set to be announced by the finance minister on February 1, 2023. Furthermore, over the next few years, an increasing amount of focus will be placed on industrial infrastructure. The spending on infrastructure projects coupled with the projected decline in prices of construction materials will aid construction industry growth in India over the next few quarters.

In China, policy measures from Beijing are expected to revive the growth of the construction market. The new credit policy, for instance, announced by the government in January 2023, aims to drive urban housing sales in the country. To drive housing sales in China, many local authorities announced voucher schemes. Earlier in 2022, the government also announced a pledge of US$29 billion in special loans, thereby allowing construction firms to finish stalled projects.

In Europe, labor shortage issue has been one of the major pain points for construction firms. With resulting project delays and higher labor costs, construction firms are projected to seek alternative solutions that can have a positive impact on their cash flow and bottom line. With prefabricated construction firms are not only able to save on construction costs, but also finish projects at a much faster rate and in a more controlled environment. Consequently, ConsTrack360 expects that persistent labor shortage issues faced by construction firms in Europe will lead to higher adoption of prefabricated construction methods over the next three to four years in the European region.

In the United States, the macroeconomic environment is disrupting data center construction activities. This has resulted in tech firms pulling out their investment from hyper-scale data center projects. With economic uncertainties projected to continue in 2023, ConsTrack360 expects more firms to announce construction pauses and delays from the short-term perspective.

In the Middle East, especially in the Emirates, the demand for luxury housing units is expected to grow even further over the next 12 months. The influx of foreign investors, including those moving to the country due to the ongoing war between Russia and Ukraine, is expected to keep driving the demand for such housing units. Owing to the growing demand, ConsTrack360 expects more construction developers and contractors to pick up new luxury housing construction projects from the short to medium-term perspective, thereby supporting the growth of the residential construction market across the region.