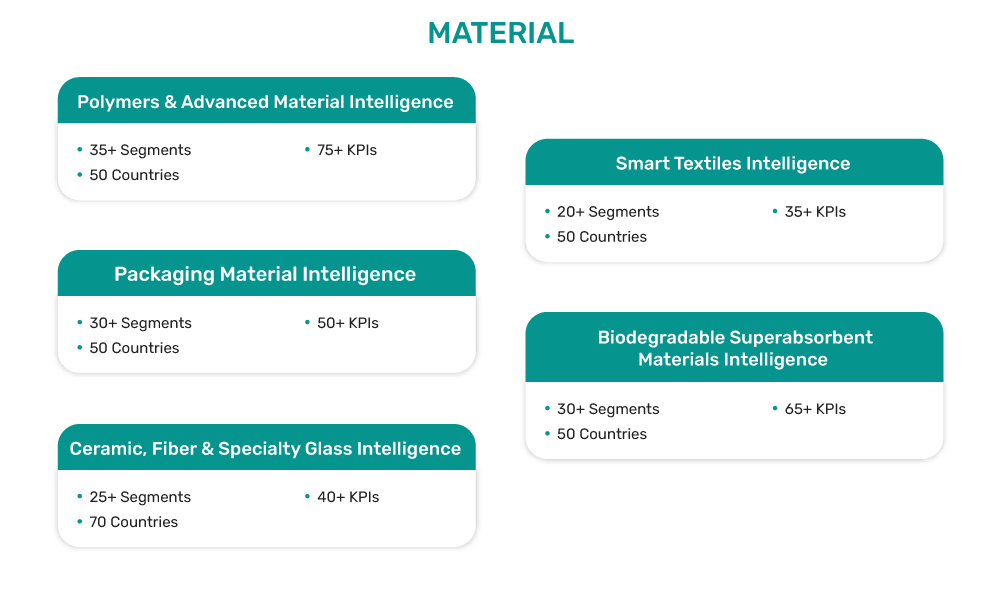

ConsTrack360's Material Intelligence offering analyzes high growth segments in over 40 industry segments, offering a quantified view of market opportunities and risks across global markets.

ConsTrack360’s Material Intelligence provides detailed country specific insights with comprehensive industry databases and analyses. The database covers 50+ materials across 40+ sectors and 100+ application areas, covering 50 top economies.

Experience the power of 360° intelligence, combining best practices, emerging business models, disruptive technology, and market innovation to identify unique opportunities.

Find out more

ConsTrack360 combines industry dynamics, impact of disruptive technologies, and market innovations to offer the most comprehensive intelligence.

Leveraging a global network of analysts, we create business intelligence offerings focused on delivering accurate data and actionable insights.

ConsTrack360’s proprietary analytics platform tracks thousands of data sources to provide quantified actionable intelligence.

Track development across value chain in over 70 key economies, delivering comparable datasets for better investment and strategic decision making.

The global cement industry is projected to stabilize in 2023, after facing a difficult year in 2022, owing to higher energy prices and soaring inflation. The reopening of the Chinese economy, along with the policy measures announced by Beijing to revive the construction and real estate market, will support global cement consumption over the next 12 months. Beyond China, the demand for cement is also projected to increase at a modest rate in India in 2023. This will be driven by pre-election spending on infrastructure projects and a further recovery in urban housing.

In the Middle East, public works are projected to increase, which will also assist the demand for cement in the region. In Saudi Arabia, mega construction projects such as Neom will lead the cement consumption. In the United Arab Emirates, on the other hand, a strong recovery in the tourism and housing sector will drive the demand for cement over the next 12 months. Cement makers are expected to benefit from the macroeconomic environment across the region, as cement prices are projected to further increase over the next 12 months.

The fear of recession in Europe and America is projected to dampen cement consumption from the short to medium-term perspective. The Russia-Ukraine conflict is projected to keep impacting the consumption of cement in Europe in 2023. The consistent increase in interest rates is bringing an end to the long-running housing booms. In Russia, where sanctions are having a greater impact, cement demand is projected to report a sharp decline in 2023. While energy prices are set to decline over the next 12 months, cement prices are projected to increase in 2023. This will further impact cement consumption in many European markets.

Although macroeconomic factors are projected to affect the cement industry growth in 2023, innovation in the sector is expected to continue over the next 12 months in Europe. Government institutions, such as in Ireland, are introducing policy measures that specify the usage of low-carbon construction methods and low-carbon cement for construction projects in 2023 and beyond. The Irish government has also pledged to support the research and development efforts of cement and construction material companies. This will keep driving further innovation and investment in the sector over the next three to four years.

In Latin America, especially in Brazil, cement consumption is projected to increase in 2023. The Federal government has given signs that it plans to invest more in low-income housing projects. This will, therefore, support a partial recovery in the Brazilian cement industry over the next 12 months. Furthermore, the investment in infrastructure projects, mainly highway repair projects, will also drive cement consumption in the Latin American market from the short to medium-term perspective.